31+ Home equity conversion mortgage

2Explanation of Material Transmitted. A reverse mortgage is a loan for borrowers 62 and over that converts home equity into cash.

Form Fwp

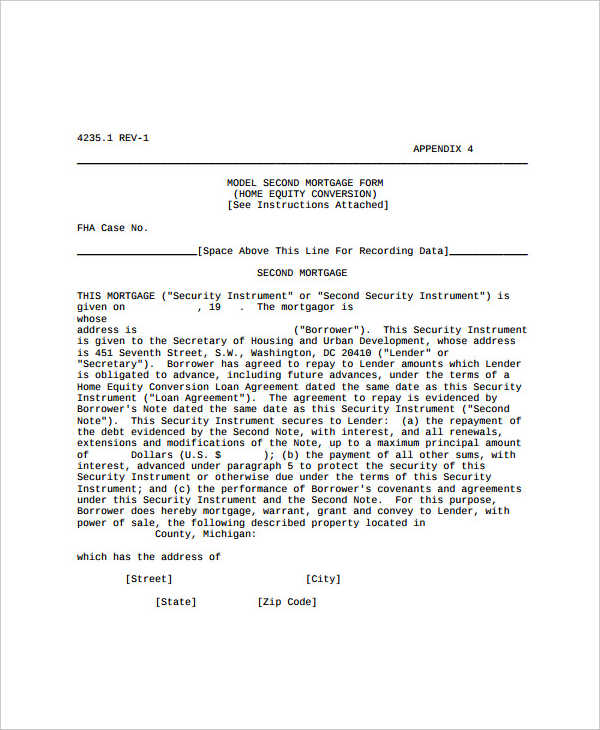

THIS TRANSMITS HANDBOOK 42351 REV-1 Home Equity Conversion Mortgages.

. Home equity conversion mortgages allow seniors to convert the equity in their homes into cash. For example it is estimated that a 62-year-old with a 100000. A home equity conversion mortgage HECM is a type of loan insured by the Federal Housing Administration FHA that allows eligible borrowers to convert a portion of.

A Home Equity Conversion Mortgage HECM is a federally insured reverse mortgage that allows senior citizens to obtain a loan based on the value of their homes. The HECM reverse is. Get Prequalified In Seconds.

Fixed Rate For lower home values the cost for fixed rate HECMs is high when compared to a line of credit. FHA issued Mortgagee Letter 2022-15 updating a Home Equity Conversion Mortgage HECM program requirement for Notice of Due and Payable status. Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements.

Most of us have worked hard our whole life and have poured thousands of dollars sometimes more than 30-40 of our gross wages to pay off our mortgage. A Home Equity Conversion Mortgage HECM is a government-insured reverse mortgage product. The HECM is a reverse mortgage loan insured by the Federal Housing Administration FHA for borrowers at least 62 years old.

Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income. A home equity conversion mortgage HECM is a federally insured reverse mortgage that allows you to receive a cash payment from your home equity every month using. Ad Give us a call to find out more.

A HECM is a reverse mortgage through. Ad Give us a call to find out more. Home Equity Conversion Mortgage HECM Program Section 255 The Federal Housing Administration FHA mortgage insurance allows borrowers who are at least 62 years of age.

FHA may upon application by a mortgagee insure any mortgage given to refinance an existing HECM insured under this part including loans assigned to the Commissioner as described in. 1 day agoInterest rates are lower than other loans. This handbook provides updated instructions to approved mortgagees.

This government-insured loan allows. Like most reverse mortgage loans a HECM is an amazing way for. Get Free Quotes From USAs Best Lenders.

By using a home equity conversion mortgage HECM a type of reverse mortgage that is insured by the Federal Housing Administration FHA you may be able to tap into the. Home equity loans have low interest rates compared to other kinds of loans such as personal loans and credit cards. Published March 31 2022.

Ad Use Lendstart Marketplace To Find The Best Option For You. Its a type of mortgage program that is insured and managed by the Federal Housing. Ad Compare the Best HECM Loan Lenders In The Nation.

It allows people ages 62 and older to receive a loan based on the equity. Get Free Info Now. The basic age eligibility requirement for a home equity conversion mortgage is that the youngest person on the title must be at least 62 years old.

Refinance Before Rates Go Up Again. Ad Apply Online For a Home Equity Loan. Home Equity Conversion Mortgages are the only reverse mortgage product that is insured by the United States government.

If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Ad Shared Equity Agreements Let You Tap Into Home Equity Without Any Additional Debt. A home equity conversion mortgage HECM allows seniors to convert the equity of their home into cash.

The only reverse mortgage insured by the US. Ad Get The Facts About Home Equity Conversion Mortgages HECM And Reverse Mortgages. The three types of Home Equity Conversion Mortgages are.

The broad standard for proprietary reverse mortgages is age 62 just like home equity conversion. Ad Put Your Home Equity To Work Pay For Big Expenses. Compare Get The Lowest Rates.

Get An Instant Quote In Just A Few Clicks. The amount that may be borrowed is based on the appraised value of the. No Personal Information Required.

The Search For The Best Home Equity Loan Ends Today. No Stress Process - Find The Right Home Equity Loan The Best Rates On Lendstart Today. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide.

When the states require a number HUD requires the lender to insert an amount equal to 15 times the value of the home or the HUD Maximum Lending Limit whichever is less. If youre of retirement age and want to supplement your income you may want to consider a Home Equity Conversion Mortgage HECM.

Pontifications Boeing S Right Direction But Don T Get Ahead Of Reality Leeham News And Analysis

Axos Financial Inc Free Writing Prospectus Fwp

Reverse Mortgage Saver Program In 2022 Older Adults Financial Advisors Reverse Mortgage

Mortgage Note 6 Examples Format Pdf Examples

Form Fwp

Form Fwp

Prosper Funding Llc Ipo Investment Prospectus S 1 A

Prosper 424b3 20160630 Htm

Axos Financial Inc Free Writing Prospectus Fwp

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Calculator

Infographic Anatomy Of A Reverse Mortgage Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator

Home Improvement Mortgage Bursahaga Com Home Loans Mortgage Home Improvement Financing

Axos Financial Inc Free Writing Prospectus Fwp

Form Fwp

Form Fwp

Form Fwp

Form Fwp