Payroll calculator massachusetts

Massachusetts is returning 2941 billion in excessive revenue to taxpayers thanks to an obscure law from 1986. Calculating paychecks and need some help.

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. Massachusetts new hire online reporting. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. Paycheck Results is your.

Massachusetts Department of Revenue. 3 Months Free Trial. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Compare This Years Top 5 Free Payroll Software. Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Use this Massachusetts gross pay calculator to gross up wages based on net pay. How to calculate annual income. Child Tax Credit Tool.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Overview of Massachusetts Taxes. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

For example if an employee receives 500 in take-home pay this. After a few seconds you will be provided with a full. Tax Calculators Tools.

Massachusetts Hourly Paycheck And Payroll Calculator When it comes to tax withholding employees face a trade-off between bigger paychecks and a smaller sized goverment tax bill. That goes for both earned income wages salary commissions and unearned income. Simply enter their federal and state W-4.

For 2022 the new state average weekly wage is 169424 and the new maximum weekly benefit. Just enter the wages tax withholdings and other information. Massachusetts has some of the highest cigarette taxes in the nation.

Free Unbiased Reviews Top Picks. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts.

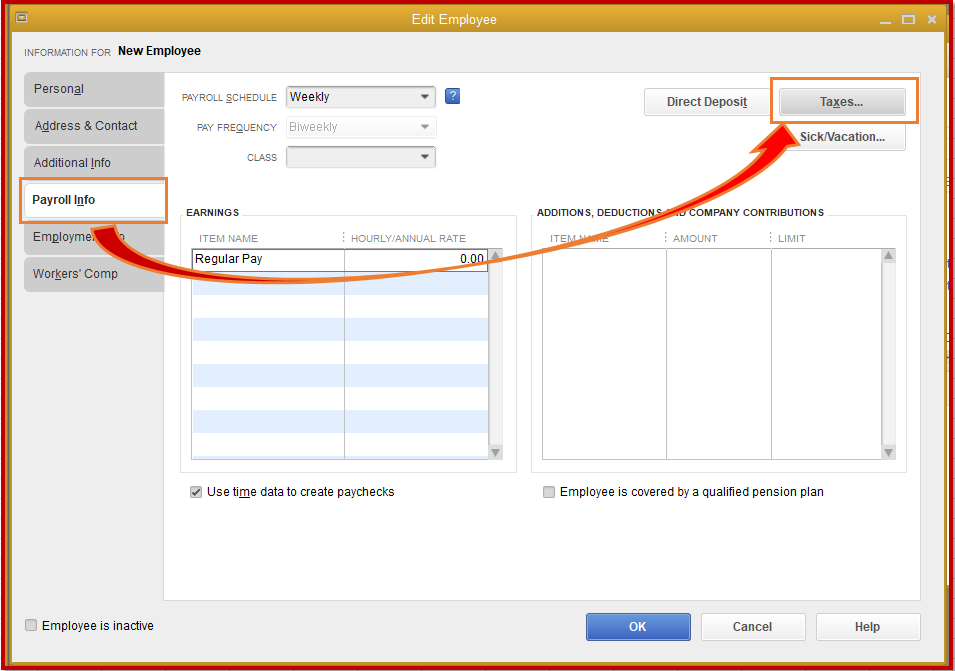

2022 Tax Calculator Estimator - W-4-Pro. This calculation is also subject to a cap that in 2022 is 64 of the SAWW. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Below are your Massachusetts salary paycheck results. The ballot question called Chapter 62F allows for tax. Massachusetts Hourly Paycheck Calculator.

For example if an employee earns 1500. Get Started With ADP Payroll. All Services Backed by Tax Guarantee.

Starting as Low as 6Month. Massachusetts is a flat tax state that charges a tax rate of 500. New employers pay 242 and new.

All Services Backed by Tax Guarantee. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Massachusetts Hourly Paycheck Calculator Results. The results are broken up into three sections. Get Started With ADP Payroll.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Payroll for all permanent temporary and contract employees dating back to Calendar Year 2010 is updated bi-weekly for the Legislative Judicial and Executive. Ad Payroll So Easy You Can Set It Up Run It Yourself.

2021 Tax Year Return Calculator. Free Unbiased Reviews Top Picks. Ad Payroll So Easy You Can Set It Up Run It Yourself.

So the tax year 2022 will start from July 01 2021 to June 30 2022. This contribution rate is less because small employers are not. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The tax is 351 per pack of 20 which puts the final price of cigarettes in. Small Business Low-Priced Payroll Service. Ad Process Payroll Faster Easier With ADP Payroll.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

Massachusetts Fli Calculations

Massachusetts Paid Family Leave Not Calculating Correctly

How Much Will Artists Be Paid Under The New W A G E Certification Program Artistic Space Paradigm Certificate

Payroll Information For Massachusetts State Employees Office Of The Comptroller

![]()

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

Job Progress Report Template 3 Templates Example Templates Example Progress Report Template Report Template Progress Report

Payroll Software Solution For Massachusetts Small Business

Ether Monument Monument Statue Ethereal

Learn More About The Massachusetts State Tax Rate H R Block

Payroll Software Solution For Massachusetts Small Business

Wegmans In Northborough Ma Amazing Supermarket Http Www Visitingnewengland Com Wegmans Northborough Ma Html Wegmans New England Road Trip Supermarket

Pin Page

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paid Family Leave Not Calculating Correctly

Unionized Mass Moca Workers To Strike Amid Contract Negotiations Artnews Com

Massachusetts Salary Calculator 2022 Icalculator

The Minimum Wage I Make Isn T A Living Wage Cnn Money Massachusetts Institute Of Technology Career Exploration